July 11,2025, Mumbai

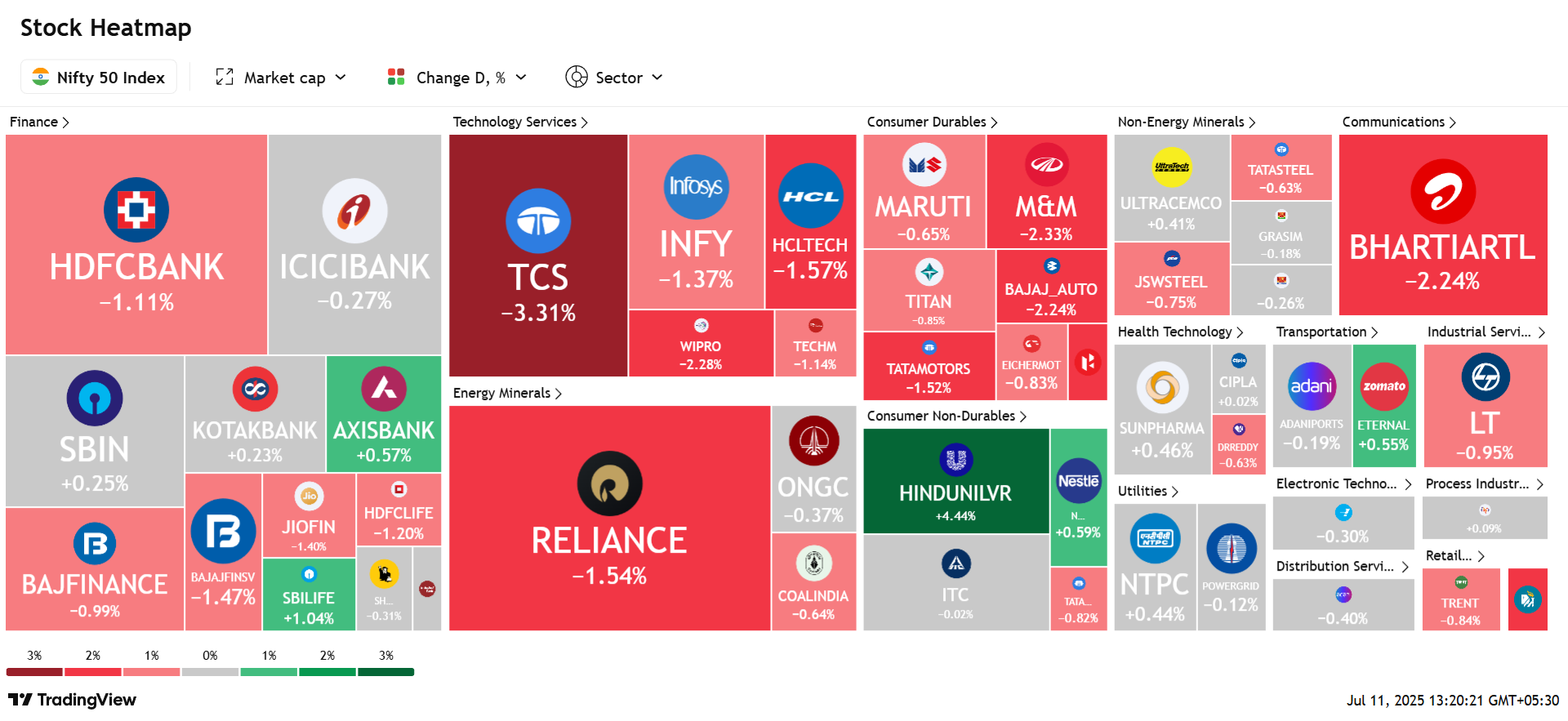

Stock market crash concerns gripped Indian investors today as benchmark indices witnessed steep declines. The Sensex dropped by over 700 points, and the Nifty broke below the 25,200 mark. The sharp correction was driven by a combination of disappointing corporate earnings, global trade tensions, and a surge in crude oil prices. A breakdown of technical support levels added to the panic, triggering broad-based selling. This article explains the reasons behind the ongoing stock market crash and its implications for investors.

Weak Earnings from Major IT Companies Spark Panic

The decline was led by the IT sector, which faced heavy selling pressure following the release of quarterly earnings by Tata Consultancy Services. The company reported lower-than-expected numbers, leading to a nearly two percent fall in its share price. The negative sentiment spilled over to other large-cap IT stocks such as Infosys and HCL Technologies. Given the sector’s weightage in both the Sensex and Nifty, the sell-off in IT played a central role in triggering the broader market downturn.

Investors also raised concerns over profit margins and global demand uncertainties impacting the technology sector, contributing to sustained selling throughout the trading session.

Read: TCS Share Price Constrains Gains Ahead of Q1 Earnings; Peer Pressure Mounts

Global Trade Tensions and Tariff Fears Shake Sentiment

Investor sentiment was further dampened by geopolitical developments, particularly involving trade tensions. Former United States President Donald Trump announced a thirty-five percent import tariff on Canadian goods. This aggressive move has raised fears of retaliatory action and the potential revival of a global trade war.

Global financial markets reacted negatively to this development. The Indian markets mirrored these cues, as the possibility of prolonged protectionist policies renewed concerns around global economic growth and trade stability. The ripple effect of such policies, especially in export-dependent sectors, weighed heavily on investor confidence and led to broad-based selling.

Also Read : Trump’s 35% Tariff Plan Challenges Carney’s Conflict-Averse Trade Strategy

Rising Crude Oil Prices Add to Inflation Concerns

In addition to earnings and geopolitical issues, the rise in crude oil prices added pressure to the equity markets. Brent crude crossed eighty-five dollars per barrel following heightened tensions in the Middle East and restricted supply forecasts.

For an oil-importing country like India, elevated crude prices lead to higher input costs, reduced corporate margins, and increased inflationary risks. Sectors such as aviation, transport, logistics, paints, and fast-moving consumer goods were hit hardest as operating expenses are directly affected by fuel costs. The surge in oil prices also weakens the Indian rupee, impacting companies dependent on foreign imports and raw materials.

Technical Breakdown Accelerates the Fall

From a technical standpoint, the Nifty breached a key support level of 25,200 during the day. This breach triggered automated sell signals for algorithmic trading platforms and institutional investors, leading to accelerated selling in the second half of the trading session.

Technical analysts have pointed out that if the Nifty does not hold above 25,000 in the near term, the markets could see further correction. Traders and short-term investors exited positions rapidly, contributing to increased market volatility and creating a cascading effect on stock prices.

Key Data Highlights

- Sensex closed lower by 712 points

- Nifty ended below 25,200, down by over 200 points

- TCS fell around 2 percent post earnings release

- Brent crude traded above 85 dollars per barrel

- Nifty IT index declined by more than 2.5 percent

- Rupee weakened against the US dollar amid global uncertainties

Investor Strategy: What to Do Amid the Stock Market Crash

In periods of heightened volatility, it becomes essential for investors to avoid panic-driven decisions. Experts advise focusing on companies with strong balance sheets, healthy cash flows, and resilient business models.

Short-term traders should be cautious and wait for clear support levels to form before taking fresh positions. Long-term investors can consider this correction as a potential opportunity to accumulate quality stocks at lower valuations, but only after reassessing sectoral risks.

Diversification across asset classes and sectors remains critical. Defensive sectors such as fast-moving consumer goods, healthcare, and utilities may offer better stability in the near term.

Today’s stock market crash is a reflection of a convergence of global and domestic pressures. While short-term sentiment remains fragile due to weak earnings, trade uncertainty, and rising inflation risks, the broader outlook for the Indian economy continues to remain stable over the long term.

Investors should stay vigilant, monitor developments closely, and maintain a disciplined approach in portfolio management.