NVIDIA Share Price Hits New Peak as Company Crosses $4 Trillion Valuation

NVIDIA Corp (NASDAQ: NVDA) has officially become the first semiconductor company to reach a $4 trillion market valuation, following a strong surge in its stock price. The NVIDIA share price rose to an intraday high of $164.37 on July 9, 2025, reflecting a 3% intraday gain and continuing a year-long rally fueled by unprecedented demand for AI-related computing hardware.

This milestone cements NVIDIA’s dominance not just in the chip industry, but across the entire tech sector. It is now positioned as one of the world’s most valuable public companies—outpacing legacy players in software, hardware, and internet services alike.

AI Demand Fuels Unstoppable Growth in NVIDIA Share Price

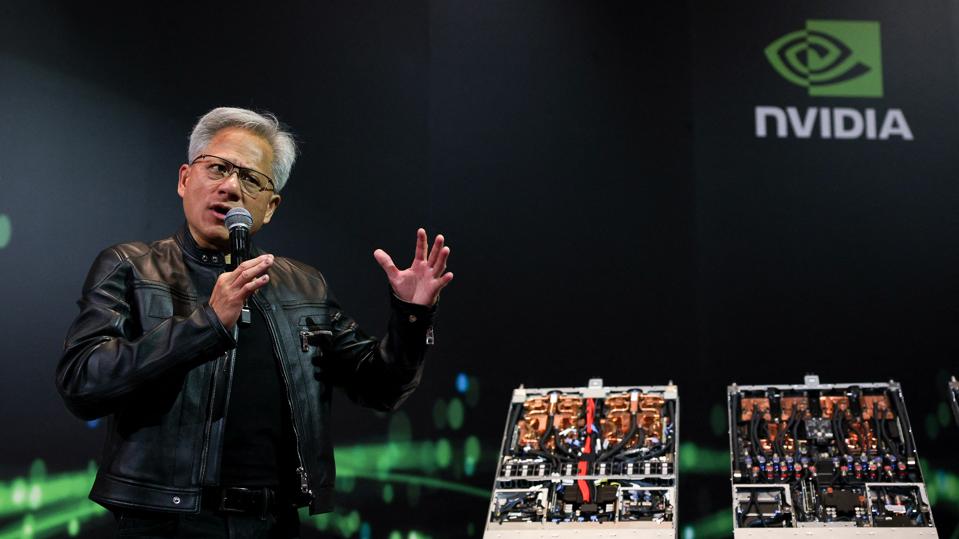

At the heart of this meteoric rise lies NVIDIA’s strategic leadership in artificial intelligence chipmaking. The company’s H100 and newly launched Blackwell B100 GPUs are now considered the backbone of AI infrastructure globally, powering data centers, research labs, government models, and enterprise AI deployments.

The company’s share price has appreciated over 25% year-to-date and more than 1,400% over the last five years, as institutional and retail investors continue to view NVIDIA as the cornerstone of the AI revolution.

Analyst Upgrades and Price Target Revisions Reflect Bullish Sentiment

Several leading brokerage firms have upgraded their price targets for NVIDIA shares, reflecting growing optimism over long-term revenue visibility. The consensus analyst target now stands at $174, with firms like Citi projecting highs of $190.

Key drivers behind these upgrades include:

- Surging demand for sovereign AI projects, where governments are independently building AI infrastructure

- Strong uptake of NVIDIA’s CUDA platform and AI SDKs

- Anticipation of accelerated demand for Blackwell architecture GPUs in Q3 and Q4

As a result, the NVIDIA share price is expected to remain buoyant even in the face of broader tech sector volatility.

Market Momentum Lifts the Broader Semiconductor Sector

NVIDIA’s performance is having a halo effect on the entire semiconductor ecosystem. The iShares Semiconductor ETF (SOXX) has rallied approximately 12% in 2025, outperforming the NASDAQ and S&P 500. Other chipmakers and AI-adjacent companies are also witnessing investor inflows, as NVIDIA’s success validates the long-term growth potential of high-performance computing and machine learning.

Moreover, the surge in NVIDIA share price is driving renewed interest in AI supply chain stocks—from memory suppliers to PCB manufacturers.

Key Risk Factors: Export Regulations and Supply Constraints

While the momentum is clearly bullish, NVIDIA faces a few looming challenges. Chief among them is geopolitical risk tied to U.S. export restrictions. Regulatory limitations on AI chip shipments to China and other sensitive markets could weigh on revenue projections in future quarters.

Additionally, supply chain bottlenecks, particularly in advanced packaging and HBM (High Bandwidth Memory) supply, could slow down NVIDIA’s ability to meet growing global demand. However, the company has proactively diversified suppliers and manufacturing capabilities to mitigate these concerns.

What to Watch: Q2 Earnings and Blackwell Ramp-Up

NVIDIA’s Q2 FY2026 earnings, scheduled for August 27, 2025, are now one of the most anticipated events on Wall Street. Analysts expect:

- Revenue to exceed $45 billion

- Gross margins near 72%

- Strong forward guidance based on early Blackwell GPU shipments and sustained data center expansion

Investors are also closely watching signs of long-term AI adoption in non-traditional sectors such as healthcare, retail, and automotive, which could further expand NVIDIA’s total addressable market.

NVIDIA Share Price Positioned for Sustained Upside

The NVIDIA share price is not just a reflection of short-term trading activity—it represents the strategic transformation of a company that is leading the charge into the AI-powered future. As more enterprises, governments, and institutions double down on AI infrastructure, NVIDIA remains a first-mover with unmatched scale and product depth.

For investors, NVIDIA continues to offer a compelling narrative: a tech stock that is not only benefiting from the AI boom, but actively defining its trajectory. If current trends persist, the company’s valuation may not stop at $4 trillion—and the NVIDIA share price could find new highs in the quarters ahead.

Also Read: Trump 2025 tariffs and India: What They Mean for India and the Future of Global Trade

3 thoughts on “NVIDIA Share Price Surges to Record High Amid Soaring AI Demand and $4 Trillion Valuation”